Introduction

China’s pet food manufacturing industry is undergoing a period of rapid transformation. With growing pet ownership, rising disposable incomes, and changing consumer preferences, the sector is poised for significant growth. This article examines the future of pet food manufacturing in China, exploring key opportunities and challenges. Central to this discussion is the emerging demand for innovative products such as cat treats factory and how manufacturers are responding to evolving market trends.

Rising Pet Ownership and Market Growth

In recent years, China has experienced a notable surge in pet ownership, with millions of households welcoming dogs, cats, and other companion animals. This shift is driven by urbanization, changing family structures, and an increased emphasis on lifestyle and emotional well‑being. Pets are now widely regarded as members of the family, prompting owners to invest in higher‑quality food and specialized products. As a result, the pet food market has expanded rapidly, making China one of the most dynamic regions for pet food consumption globally.

The demand for premium pet food is particularly strong among urban, middle‑class consumers who are willing to pay more for products that promise better nutrition, natural ingredients, and enhanced taste. This trend opens up substantial opportunities for domestic and international manufacturers to introduce differentiated offerings tailored to Chinese pet owners’ preferences.

Consumer Demand for Premium and Functional Products

One of the most significant trends shaping the future of pet food manufacturing in China is the shift from basic nutrition toward premium and functional products. Consumers are increasingly seeking food that meets specific health needs, such as weight management, digestive support, and grain‑free options. This shift mirrors broader global trends in human food consumption, where health and wellness are top priorities.

Within this context, products like dried cat treats have gained popularity as pet owners seek convenient, nutritious, and enjoyable ways to reward and bond with their pets. These treats not only serve as indulgences but are also formulated with added health benefits, such as vitamins, minerals, and proteins that support overall well‑being. The integration of functional ingredients into snacks and treats is expected to drive growth in the segment and encourage manufacturers to innovate continuously.

Technological Advancements in Production

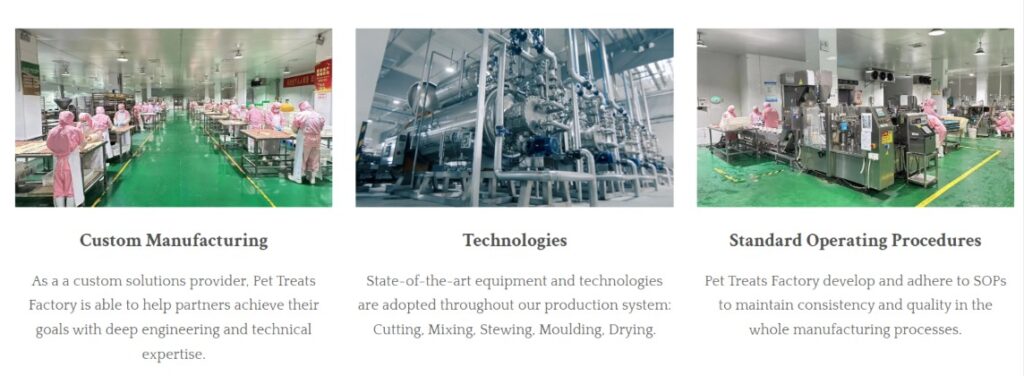

To meet the rising demand for high‑quality pet food, manufacturers in China are investing heavily in modern production technologies. Automation, precision processing, and advanced quality control systems are becoming essential components of the manufacturing landscape. These technologies enable producers to enhance efficiency, reduce waste, and maintain consistent product quality.

Moreover, advancements in food science are allowing companies to explore novel formulations that cater to specific nutritional needs. For instance, innovations in processing methods can help preserve the natural flavors and nutrients in ingredients used for dried cat treats, boosting their appeal to discerning pet owners. Enhanced traceability and data‑driven production also allow manufacturers to monitor and optimize every step of the supply chain, reinforcing consumer confidence in product safety and quality.

Regulatory Environment and Quality Standards

As the pet food industry grows, regulatory oversight in China is also evolving. Authorities are placing greater emphasis on establishing and enforcing quality standards to ensure the safety and nutritional adequacy of pet food products. This regulatory framework is crucial for maintaining consumer trust and protecting pets’ health.

However, navigating the regulatory landscape presents challenges for manufacturers, especially smaller enterprises. Compliance with stringent safety protocols, labeling requirements, and ingredient transparency guidelines requires significant investment in infrastructure and expertise. While larger firms may have the resources to adapt quickly, smaller players might struggle to keep pace, potentially leading to market consolidation.

Despite these challenges, the establishment of clear and robust regulations ultimately benefits the industry by promoting higher standards and leveling the playing field for all manufacturers. Companies that proactively align their practices with regulatory expectations will be well‑positioned to gain consumer trust and expand their market reach.

E‑Commerce and Digital Innovation

Digital platforms are playing an increasingly important role in China’s pet food market. E‑commerce channels, social media, and mobile apps have transformed how consumers discover, research, and purchase pet food products. Platforms such as Taobao, JD.com, and Tmall offer a vast array of pet food brands, enabling consumers to compare products, read reviews, and make informed decisions with ease.

For manufacturers, this digital shift presents both opportunities and challenges. On one hand, e‑commerce provides unprecedented access to a vast and diverse customer base. Brands can leverage targeted advertising, influencer partnerships, and online promotions to build awareness and drive sales. Products such as dried cat treats benefit from this exposure, especially when marketed with compelling content that highlights quality, ingredients, and unique selling points.

On the other hand, the competitive nature of online marketplaces requires manufacturers to continuously innovate and differentiate their offerings. Investing in digital marketing, brand storytelling, and customer engagement is essential to stand out in a crowded space. Additionally, companies must manage logistics and fulfillment efficiently to meet consumer expectations for fast delivery and responsive service.

Sustainability and Ethical Considerations

Sustainability has become a key concern for pet owners around the world, and Chinese consumers are increasingly mindful of the environmental and ethical implications of the products they buy. This trend is influencing the pet food industry, prompting manufacturers to consider eco‑friendly practices throughout their operations.

From sourcing sustainable ingredients to minimizing packaging waste, companies are exploring ways to reduce their environmental footprint. Innovations in alternative proteins, such as insect‑based meals or plant‑derived ingredients, are gaining traction as sustainable options for pet food formulations. These alternatives appeal to environmentally conscious consumers seeking products that align with their values.

Moreover, ethical considerations extend to animal welfare and responsible sourcing. Brands that prioritize transparency and ethical supply chains are likely to earn greater trust from consumers who view pet food purchases as an extension of their personal ethos. As sustainability becomes a more prominent factor in buying decisions, manufacturers will need to adapt to these expectations to remain competitive.

Competition and Market Fragmentation

China’s pet food market is characterized by intense competition and fragmentation. Domestic brands compete with well‑established international players, each vying for market share in a rapidly growing industry. While international brands often benefit from strong brand recognition and perceived quality, local manufacturers are increasingly gaining traction by offering products tailored to Chinese tastes and preferences.

This competitive environment drives innovation and encourages companies to differentiate their product portfolios. For example, some manufacturers focus on niche segments such as organic pet food, specialty diets, or premium snacks like dried cat treats. Others emphasize affordability and accessibility, aiming to capture broader segments of the market.

However, fragmentation also poses challenges. Smaller brands may struggle to build distribution networks, secure shelf space, and compete with larger companies’ marketing budgets. Strategic partnerships, mergers, and collaborations may become more prevalent as brands seek to strengthen their positions and expand their reach.

Future Outlook

Looking ahead, the future of pet food manufacturing in China appears promising, with substantial growth potential driven by evolving consumer preferences, technological advancements, and expanding digital commerce. The demand for high‑quality, innovative products such as dried cat treats will continue to shape the market landscape.

To thrive in this dynamic environment, manufacturers must embrace innovation, prioritize quality and safety, and respond proactively to emerging trends. Building strong brands, investing in digital strategies, and adopting sustainable practices will be key differentiators in a competitive market.

At the same time, addressing regulatory challenges and ensuring compliance with quality standards will be essential for long‑term success. Companies that navigate these complexities effectively will be well‑positioned to capitalize on the robust growth of China’s pet food industry.

Conclusion

The pet food manufacturing sector in China is at a pivotal moment of transformation. Fueled by rising pet ownership, shifting consumer expectations, and technological progress, the industry presents compelling opportunities for manufacturers willing to innovate and adapt. While challenges such as regulatory compliance, competition, and sustainability concerns remain, the overall outlook is positive. With strategic planning and a focus on quality, companies can harness the momentum of this growing market and deliver products that resonate with Chinese pet owners—ultimately shaping the future of pet food in one of the world’s most vibrant economies.